FICO SBSS Business Credit Score: How to Understand and Improve Yours

What Is the FICO SBSS Business Credit Score?

FICO SBSS stands for Small Business Scoring Service and is a business credit score determined by both your personal and business financial habits. This score ranges from 0 to 300, with 300 being the best, and indicates your likelihood of being able to pay back a loan. The SBA currently uses the FICO SBSS to prescreen applicants and requires a score of at least 140.

If you’ve examined your business finances or are in the process of taking full stock of your business health, you’re probably gathering plenty of paperwork. You’ll want to check in on your personal credit score, your balance sheet, your profit and loss statement, and your FICO SBSS business credit score.

You might not have heard of your FICO SBSS, but it’s an important number—it’s a credit score for your business, and it could make or break your chance at securing any financing you need. And more and more lenders have been taking a closer look at it.

Your FICO SBSS isn’t something to disregard—so let’s talk about what it is, how it works, why it’s important, and how you can improve yours and use it to your advantage.

Credit Scores: An Overview

A credit score is essentially a measure of your quality as a borrower and reflects how trustworthy you are with the money you borrow.

Statistically speaking, higher credit scores strongly correlate with lower APRs and more funding products at your disposal. In other words, the better your credit score, the more loan products you can get at better prices.

There are two kinds of credit scores we’ll look at before explaining your FICO SBSS:

Personal Credit Score

When it comes to small business borrowing, your personal credit score reigns supreme. As a small business owner, your finances get lumped together with your business’s, whether that seems fair to you or not.

If you’re running a small business, then chances are your personal financial habits affect or reflect your business’s financial tendencies. If you pay your personal loans late, then you can see why business loan lenders might assume that you’ll pay your business loans late, too. And even if that’s not the case, you can’t really fault your lender for making that logical leap—they just don’t have as much data to tap into for a small business. It works the other way around too—if you have a good personal credit score, that will make lenders more likely to work with you on a business loan.

Your payment history, credit utilization ratio, the types of credit you use, and how many new lines of credit you’ve opened are all factors in your personal credit score.

In terms of goals: You’ll want to aim for a personal credit score of at least 600 if you want to qualify for favorable rates. Any lower, and you’ll likely be looking at high interest rates and short terms—which might be necessary, but it won’t be pleasant. And the higher the better, so if you can get to 700 or above, you’re in good standing for higher-quality funding.

Business Credit Score

Your business credit score, on the other hand, comes from your business’s financial habits and some other business-related factors.

It’s pretty important for small business owners to understand the difference between their personal and business credit scores and to maintain them both. To do so, you’ll need to keep your finances separate by having a designated business bank account and business credit card. Having these separate accounts and using them responsibly will help build your business credit. Plus, it will help protect your personal finances if your business runs into any financial troubles.

Keep in mind, business credit checks tend to be more rigorous than personal checks. While an important step to growing and maturing your business, establishing your business credit isn’t an easy one.

What Is the FICO SBSS?

Now that we understand the basics of business credit scores and personal credit scores, let’s take a closer look at the FICO SBSS business credit score.

FICO, or the Fair Isaac Corporation, calculates both personal credit scores and business credit scores. FICO SBSS stands for Small Business Scoring Service, and it does for small businesses what the FICO personal credit scoring service does for individual borrowers. It’s meant to reflect your small business’s creditworthiness—or offer a measure of how likely it is that your business will repay its loans on time and without issue.

As we’ve covered, a credit score is a measure of your reliability when it comes to borrowing money. But consider it this way: A credit score also tracks the risk factor of lending to you. If you have a bad credit score, lenders will see you as an unreliable borrower and as a risky investment.

In other words, your FICO SBSS helps banks and lenders analyze the risk level of investing in your business by lending you money. It’s fast, easy, systematic, and designed specifically with small business funding in mind—so it helps your lenders process more applications faster and more accurately.

How Does the FICO SBSS Work?

The FICO SBSS is different from FICO’s personal credit score as well as the business credit scores you see from credit reporting companies like Dun & Bradstreet, Equifax, and Experian.

But how is it actually different?

Factors

The FICO SBSS is actually a kind of hybrid between your personal and business credit scores. That’s because FICO draws from both your personal credit and your business credit in order to figure out your business’s FICO SBSS. Other details about your business are also factored in to find your FICO SBSS, such as how long you’ve been in business, how many employees your business has, any assets you possess, and more.

This makes a lot of sense when you think about it. By combining the two kinds of credit small business owners build, your FICO SBSS covers more ground than either your personal credit score or your business credit score. A lender can get a more in-depth look into your borrowing habits and history.

“It draws on multiple data sources and more than 100 combinations of consumer and business analytical models to help streamline the loan approval process,” is how the SBA puts it.[1]

As we discussed, lenders usually think of small business owners as their businesses. You’re inseparable in the eyes of the lender. The FICO SBSS reinforces this line of thinking by combining your personal and business finances, but that’s not necessarily a bad thing. If your borrowing habits are positive across the board, from personal loans and mortgages to your small business funding, then your FICO SBSS will portray you in a good light.

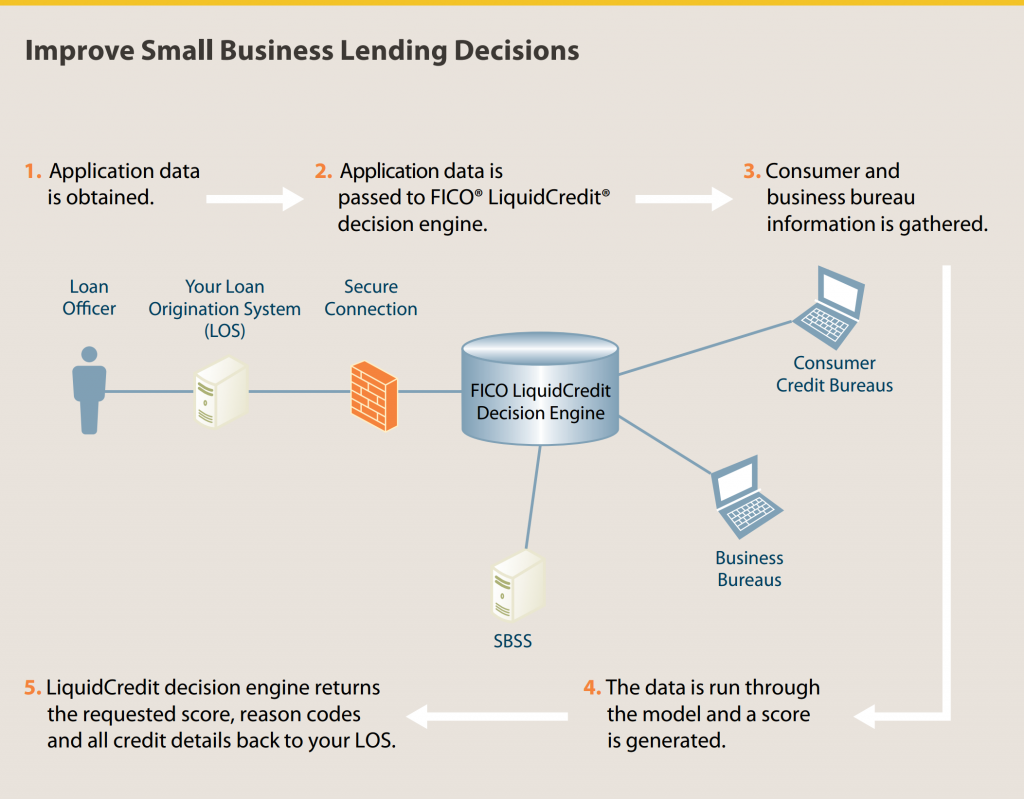

This infographic from FICO can also help you better understand the process:

Of course, how exactly FICO weighs the various parts of your financial information in order to come up with your FICO SBSS score is up for debate. But we do know FICO examines your personal credit history, business credit history, business financial data, time in business, assets and liabilities, cash flow, revenue, liens, and judgments.

The Range

The different personal and business credit scores each have their own scale, so a good personal score and a good business score will look very different.

While your personal FICO credit score ranges from 300 to 850, the highest your FICO SBSS can possibly be is 300. And the higher the better, as usual.

FICO SBSS Is Flexible

Your FICO SBSS is especially flexible, as far as credit scores go. In other words, FICO’s formula naturally adjusts for how much information you supply it—their process treats a small business like a small business, a medium business like a medium business, and a big business like a big business.

What exactly does that mean for you, though? The point is that two small businesses of very different sizes—say, one is a single freelancer while the other has two dozen full-time employees—can actually have the exact same FICO SBSS. You’re neither punished nor rewarded for your size.

This might sound intuitive—and logically, it is—but you have to remember that FICO’s formula combines business finances with the individual owner’s. It’s no small feat to adjust all that information to scale, and it’s not easy to overlook FICO’s choice to give the same benefit of the doubt to a company of one as it does to a company of a hundred.

Why Your FICO SBSS Matters

Just like any other part of your loan application, your FICO SBSS score can have an impact on whether you’re approved for business funding—and if you do, it can influence the terms of any funding you receive.

Let’s take a look at who, exactly, cares about your FICO SBSS.

Alternative Lenders

Your credit score is the number-one driver of low APRs and greater product availability. The better your credit score, the lower your APR, and the more types of loans you qualify for.

Banks turn away 4x as many small business owners looking for funding as they accept, so it’s no surprise that alternative lenders have taken off in the last decade or so. Online and alternative lending has never been a more prominent industry than it is today. Alternative lenders will definitely look at your personal credit score, and if it’s available, may take your business credit score into consideration, as well. Having strong credit scores across the board will help you qualify for the best possible loan products with the best terms.

The Small Business Administration (SBA)

The SBA started taking the FICO SBSS into account when considering applications for their 7(a) loan program in 2014.

While the SBA doesn’t lend money themselves, they instead guarantee portions of loans, reducing the risk for the actual lenders involved—typically banks—and incentivizing them to work with small businesses in the first place.

Starting in 2014, the SBA began pre-screening applicants for 7(a) loans up to $350,000 using their FICO SBSS scores. The minimum FICO SBSS score the SBA will consider is 140, but generally, they prefer small businesses with FICO SBSS scores of 160 or above. This process lets the SBA save time, money, and energy by cutting out small businesses that don’t meet their minimum, which also saves lenders on their underwriting costs.

Now, here’s an interesting fact: The maximum FICO SBSS score you can snag with zero business credit history and almost no time in business is 140. So, you technically can qualify for an SBA 7(a) loan if your business is brand-new but it’s fairly unlikely. While a 140 is possible, it’s not easy. You’ll need an unblemished personal credit history, along with incredible personal and business financials, to get a 140 FICO SBSS score without any time in business. And even then, you’re just hitting the SBA’s minimum—they’ll almost always be looking for more.

So while the SBA does give new businesses a chance, you will have a better equipped if you’ve been in business for a year or two and have the strong financials to back it up—including a FICO SBSS above 140.

Banks

Last but certainly not least, some banks have started caring about your FICO SBSS score as well.

It’s a useful score for them to consider, especially since small business lending tends to be riskier than a bank’s typical investments. Any additional piece of information you can use to show a bank that you’re a responsible borrower. As banks offer the lowest interest rates and longest terms of any lenders out there, you’ll want to keep this option open.

PNC, KeyBank, and HSBC, are just a few of the banks that use the FICO SBSS as a metric for small business creditworthiness.

How to Improve Your FICO SBSS

Whether you’re just starting your business or you’re trying to rebuild less-than-stellar credit, there are steps you can take to improve your FICO SBSS. The good news is your FICO SBSS is largely under your control. By improving your score, you’ll increase your chances of getting the funding you need for your small business. Start with these steps:

1. Maintain your personal credit.

Since your FICO SBSS is partially made up of your personal credit history, keeping your personal credit in good shape—or improving it if it needs some work—will also help your FICO SBSS score.

There are several ways to improve your credit score, but at the foundation of all these plans is one simple truth: The better borrower you are, the better your credit score will be.

So while you should pay attention to the nitty-gritty and do your part to dispute incorrect charges, negotiate collected debt records, and diversify your credit portfolio, you’ll also want to keep in mind that these are cleanup strategies.

Never lose sight of the big picture: Pay your debts in full and on time, if not early. Borrow and spend responsibly, with foresight and flexibility. See your credit card payments as temporary loans, and treat them as such. Don’t take risks you can’t recover from. Act like someone you, yourself, would have no problems lending money to, and you should be fine.

2. Build your business credit.

Your FICO SBSS also has bits of your business credit score, so having one is fairly important.

Don’t get sucked into the trap of thinking you can manage your small business with your personal credit alone. There are loads of advantages to separating out your credit scores—some of which we discussed in the first section of this article—and another is optimizing your FICO SBSS. A good business credit score will reinforce your good personal credit score, but if you’re only relying on your personal credit, your FICO SBSS will suffer.

Sign up for a business credit card and spend responsibly, using the right card for the right purchases so there’s no possibility of confusion in the future. Your lender will want to know that your business credit score accurately reflects your business spending habits—so don’t mix in any personal transactions.

3. Relax!

Finally, try not to stress too much. Yes, your FICO SBSS might feel like a new and frustrating element to deal with when thinking about funding for your business—but really, it doesn’t add anything you haven’t seen before. It’s only one part of your loan application.

Understand what it is, how it works, and how it could affect you, but don’t overestimate the importance of your FICO SBSS—or underestimate your own control over it. Be the best small business owner you can be, manage your finances responsibly and consistently, and you’ve got nothing to worry about.

Article Sources:

- SBA.gov. “Small Business Loan Credit Scoring“

Ben Rashkovich

Ben is a former content strategy manager at Fundera. He has a bachelor’s degree in English literature from Columbia University and is currently enrolled in Yale Law School. Ben has also written for eBay’s curatorial team.