State of Small Business Lending: 2017 Spotlight on Women Entrepreneurs

In November of last year, we released our first annual report on the State of Small Business Lending: Spotlight on Women Entrepreneurs. After reading stats like women entrepreneurs receive only 16% of all traditional small business loans, we wanted to know: do these same stats also ring true in online business lending?

To find out, we dove into our own internal data to look at the gender breakdown of a Fundera customer sample. The numbers spoke for themselves.

Our 2016 report, which can be revisited here, found that women entrepreneurs who applied for financing through Fundera were applying less, getting approved less often, receiving smaller loan amounts, and paying more for financing than their male counterparts.

These results were obviously disheartening, but we’ve always been confident that the online lending landscape could help fix this historically unequal market.

In celebration of October’s National Women in Small Business Month, we’ve updated our State of Small Business Lending: Spotlight on Women Entrepreneurs to see what, if any, changes have occurred within the last year.

In our 2017 report, you’ll find some things have remained lamentably the same as last year. But, we’re excited to say that in some of the most important areas, there have been positive and significant shifts since 2016.

While our industry still has a long way to go, we’re seeing some movement in the right direction. We’re hopeful that the rise of alternative lending can help make small business financing a more equitable space.

Let’s explore what has and hasn’t changed since 2016 in our State of Small Business Lending Report: Spotlight on Women Entrepreneurs.

Main Takeaways

- Women are now being approved for larger loan amounts than their male counterparts in certain product categories.

For four of the product categories Fundera offers, women qualify for larger loans than their male counterparts.Though our previous report found women entrepreneurs were offered smaller loans than men across every product category, this year women were offered a greater average loan size than their male counterparts in the credit line builder, short-term lines of credit, medium-term lines of credit, and SBA loan product categories.

- Women are receiving offers with lower APR than men in certain product categories.

On average, women qualify for lower APR than their male counterparts within three of the product categories that Fundera offers. Specifically, we saw women receive lower APR than men across three different product categories: medium-term lines of credit, invoice financing, and credit line builders.

- Women business owners still apply for business financing less frequently than male business owners do, and when they do apply for financing, women still ask for less than their male counterparts.

A startlingly low 28% of applicants at Fundera are women. However, since our last report, this number has gone up from 25%. Additionally, our last report showed that female entrepreneurs ask for roughly $35,000 less in business financing than men. Since then, the number has decreased only slightly to less than $33,000.

Small Business Lending & Women Entrepreneurs

An Amex OPEN report revealed that in 2016 alone, there were 11.3 million women-owned businesses, and those businesses generated $1.6 trillion in revenues.

The same report showed that across the nation, women are starting small businesses at a rate that’s five times the national average. While the overall small business startup rate since the recession measured up to a mere 9%, women-owned startups rounded in at a 45% growth rate.

This growth rate amounts to about 1,000 new women-owned businesses every day.

But, of course, “the picture is not all rosy.” We’ve got a lot of ground to make up.

In 2016, women-owned businesses provided nearly 9 million jobs, but they only employed 8% of the private sector workforce. They generated $1.6 trillion in revenues, but they only produced 4% of the country’s entire revenue.

Women-owned businesses now comprise 38% of U.S. companies, and this proportion continues to grow as women-founded startups form at an increasing rate.

Counterintuitively, while this growth rate steadily increases, the proportion of the nation’s total revenue from women-owned businesses hasn’t budged in 20 years.

But why? Among other factors, unequal access to funding likely lies at the center of the issue. We say it a thousand times over here at Fundera, and it bears repeating: it takes money to make money.

How can you hire more employees without an influx of capital from a loan or a venture capital firm? How can you scale your revenue without some helping hands that require a salary?

Women are starting small businesses at a constantly increasing rate, but they’re still facing barriers to growth because of the barely-budging gender gap in business financing.

While we saw many significant shifts in the past year, there’s still a lot of room to grow. Here’s where we saw the most heartening (and disheartening) shifts in women’s access to financing over the course of the past year.

In Some Product Categories, Women Receive Larger Loan Amounts

Many of the products we help connect customers to are now, on average, offering women larger loans than they offer their male counterparts.

Our data from the past year shows that SBA loans, credit line builders, short-term lines of credit, and medium-term lines of credit have all funded women entrepreneurs with larger-value loans than they’ve funded men with.

Over the past year, SBA loans for women had an average size of $200,000 and out-measured the average SBA loan for men—$142,929—by more than $50,000. Meanwhile, credit line builders for women had an average size of $51,303 and out-measured the average size of credit line builders for men—$44,440—by about $7,000.

Additionally, the average short-term line of credit for women of $12,720 out-measured the average short-term line of credit for men—$11,963.07—by about $1,000. And finally, the average medium-term line of credit lent to women of $39,000 far out-measured the average medium-term line of credit lent to men—$10,000.00—by almost $30,000.

This means that half of the small business financing products we match customers with are, on average, funding women-owned businesses with larger loans.

In Some Product Categories, Women Receive Lower APR

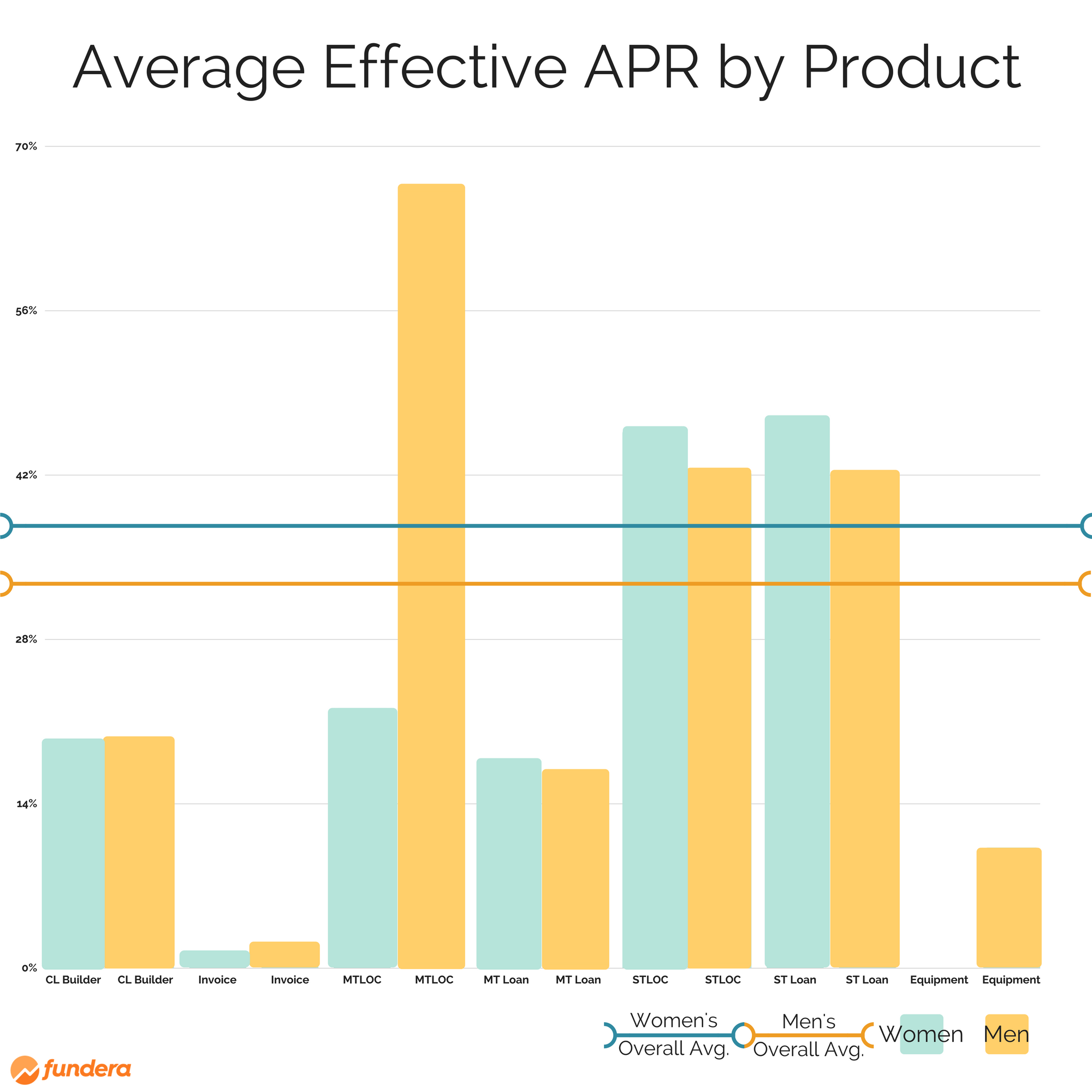

When we look at our new data broken down by loan type, we see some good news regarding the APR women entrepreneurs receive.

Credit line builders, invoice financing, and medium-term lines of credit have all lent money at lower average APRs to women than to men over the past year.

While the average APR for a credit line builder for men was 19.67%, it was 19.25% for women. Similarly, while the average APR for invoice financing for was 2.24% per week outstanding, it was 1.14% per week outstanding for women. Finally, while the average APR for a medium-term line of credit for men was 66%, women secured medium-term lines of credit with an average APR of 22% .

Women Still Aren’t Applying for Funding as Often as Men

In 2016, only 25% of the applicants on the Fundera marketplace were women. Since then, the number has increased only slightly to 28%. That means the remaining 72% of our applicants are men. This disparity remains despite the fact that 38% of the country’s businesses are owned by women and despite Fundera’s competitive organic rankings for search terms such as “small business loans for women” and “business grants for women.”

Even the demographics of the visitors to Fundera.com match the proportion of women-owned businesses in the country: 40% of visitors are women and 60% are men. What’s causing a larger proportion of these men to apply over the women?

While it seems that online lending is making slow but steady progress in evening out a market that has long been skewed by gender bias, it’s clear there’s more work left to do.

Women Still Ask for Less Money

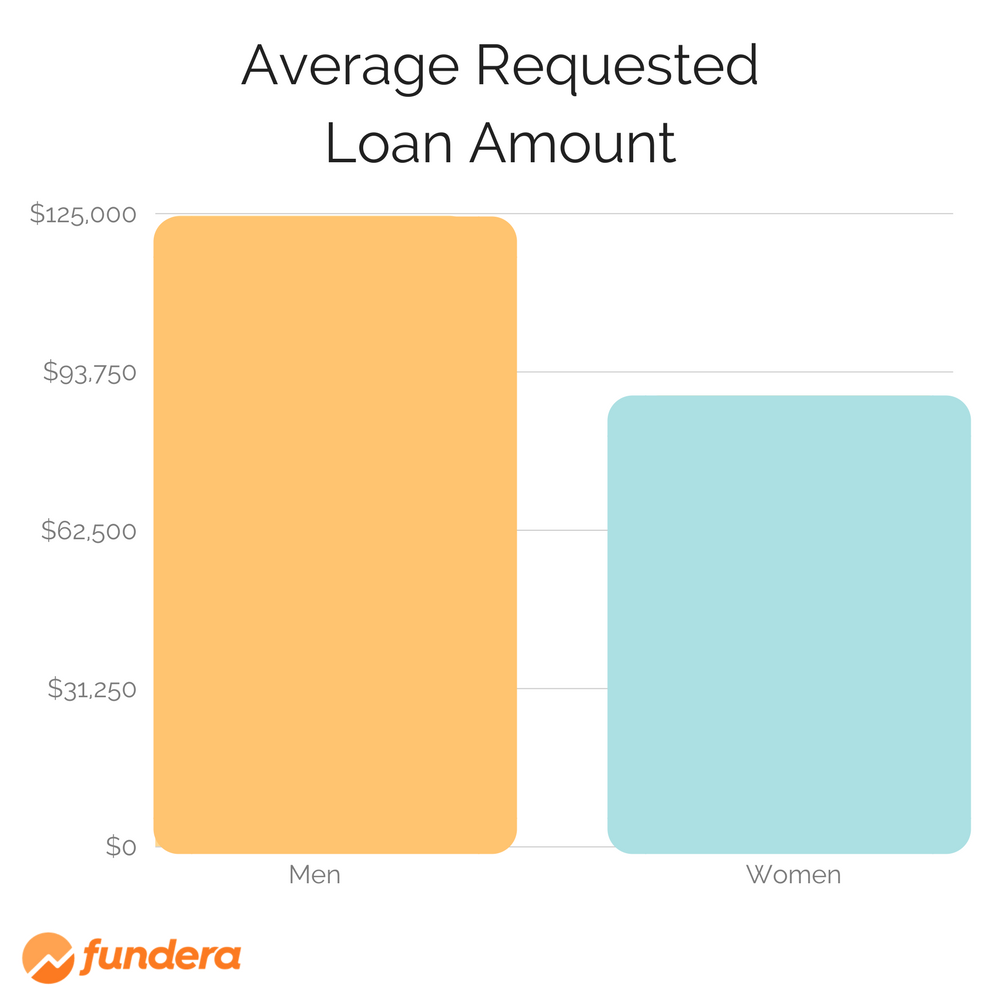

Back in 2016, we found women asked for $89,000 in debt financing on average, while men asked for an average of $124,500.

Recent data shows that both numbers have dropped, but the margin of difference has remained pretty much the same. Since our last report, women have asked for an average of $77,000 and men have asked for an average of $109,600. This means that though the margin of difference has shrunk to about $33,000 from $35,000, women are still asking for significantly less than men.

While our data can only tell us so much about this particular gap in applications for business financing, several themes remain constant. Women are four times less likely than their male counterparts to ask for a raise and four times less likely to negotiate their starting salary.

Given that working women are still making 78 cents for every dollar working men make, it’s no surprise that gender gaps exist in the realm of finance beyond individual salaries.

Overall, Women Still Receive Smaller Loans

Though specific loan types might be stepping up their game when it comes to closing the gap between loan value for women and men entrepreneurs, the average loan size across all loan types is still of higher value for male borrowers.

Overall, women receive an average loan size of $38,942 while men receive an average loan size of $43,916. That’s an average difference of nearly $5,000.

Despite the bigger loan values for women that we’ve seen since last June in four product categories, larger loan sizes for men in other products outweigh these numbers.

The gender gap between average loan amounts for men and women is particularly troubling in the medium-term loan category. These loans have relatively long terms and tend to show lower APR, making them a great quality option for many borrowers—but still, men receive an average medium term loan offer of $102,700, while women cash in much lower at an average of $84,600. Additionally, invoice financing was, on average, about $6,100 for men and $3,900 for women.

It’s true—we don’t see such drastic gaps in product categories where women qualify for less than men. However, the fact that women are so consistently underfunded in most of our product categories makes up for the giant margins we see in women receiving larger SBA loans.

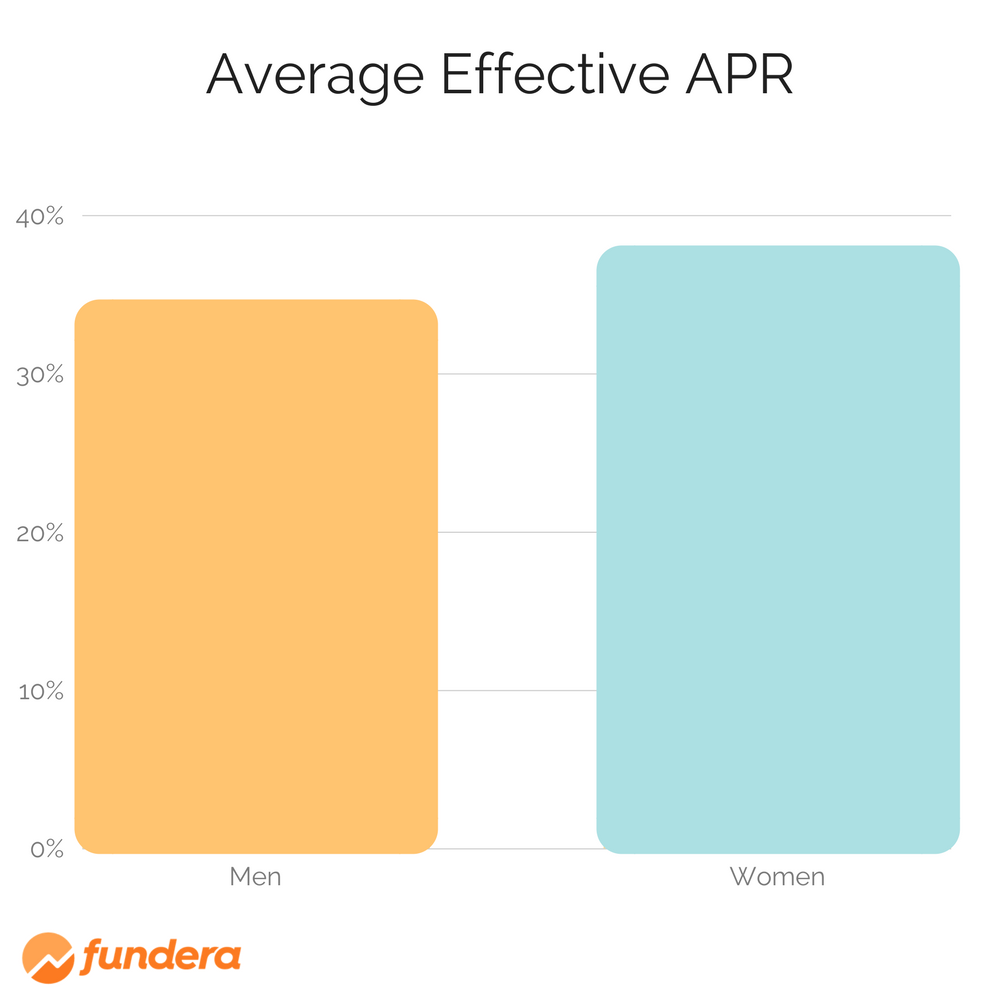

Overall, APR Is Still Higher for Women

Despite promising strides within specific loan types, overall APR is still significantly higher for women borrowers. While men on average pay a 34.66% APR on funding they’ve secured, women pay a whopping average of 38.04%.

Though the difference may seem small in terms of percentage points, a difference of that magnitude could look like thousands of dollars in financing cost. For instance, if you calculate the cost of a loan at the average overall loan size for all loans funded, $42,658, at the average overall payment term, 17 months, with the two average APRs, the difference in cost is startling.

Without even taking into account origination fees or payment schedule, this average loan at the average APR for men would end up costing the borrower around $11,900.

On the other hand, the same average loan at the average APR for women would end up costing the borrower closer to $13,200.

That’s an average of $1,300 more that women are spending due to higher APRs.

Women Entrepreneurs Are Still Less Qualified by Traditional Lending Standards

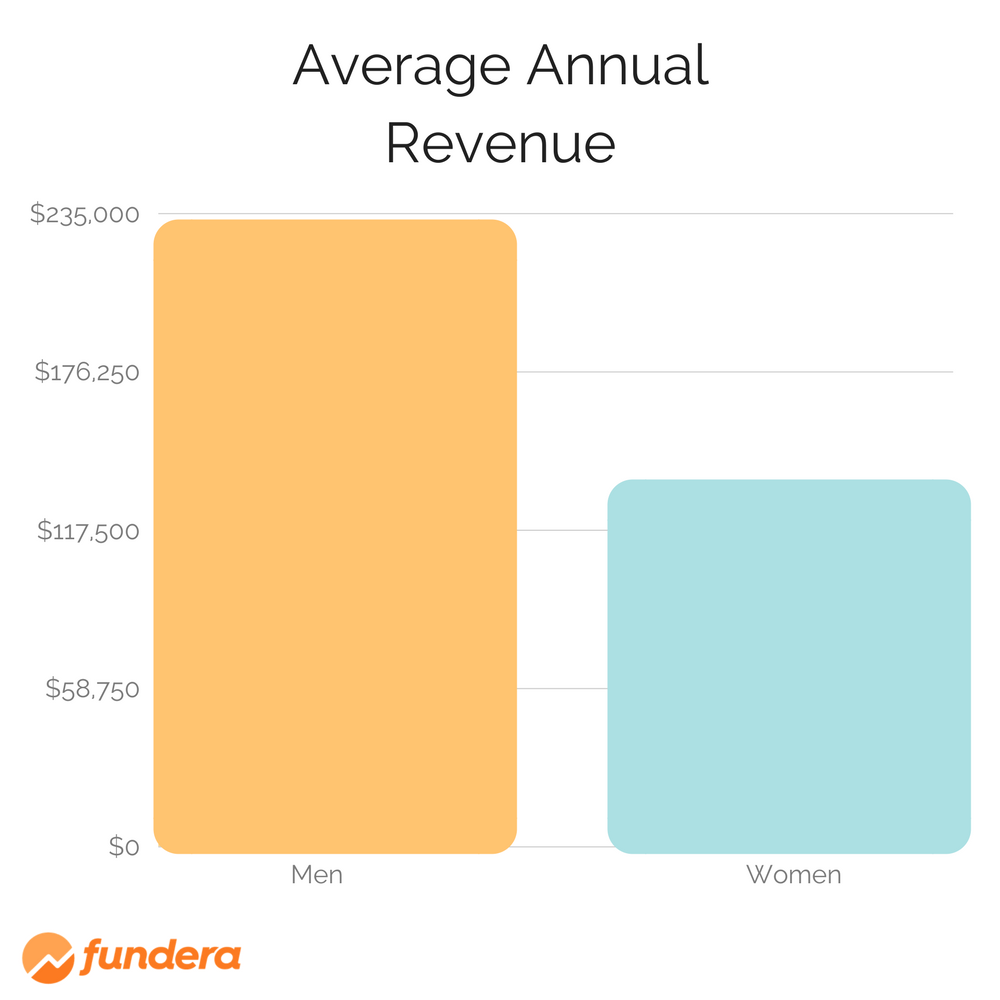

As we found in our prior report, women-owned businesses are still lagging behind men in several metrics that affect loan eligibility. In particular, two of the most important numbers that lenders consider—personal credit score and the business’s annual revenue—show a widening gender gap.

Since last June, the average credit scores for both men and women have risen. However, with this growth came a wider gap between the two averages, as well. Since our last batch of data, the average credit score for women applicants rose from 621 to 629, and the average credit score for male applicants rose from 630 to 642. This means that the gender credit score gap grew from 9 points to 13 points.

Though this might seem like a negligible difference, these numbers show that financial health is improving, but it’s doing so unevenly. That being said, while personal credit history can affect whether a business owner can find the funding they need, the difference in men and women’s average personal credit scores doesn’t place them in different credit score tiers of eligibility.

That is, as shown below, many lenders consider credit scores in clumps called tiers of eligibility. Because both gender averages fall within the same tier of eligibility, these numbers aren’t enough to explain away the less desirable loan terms women are offered.

Additionally, as we noted in 2016, women-owned businesses are making less in annual revenue than male-owned businesses. The gender disparity in annual revenue has grown by 4% in the past year—women-owned business now make 34% less than their male counterparts, compared to last year’s difference of 30%.

We’ve seen the discrepancy first-hand on our platform: in the past year, women-owned businesses that applied for funding through Fundera earned an average of $135,000 in annual revenue while their male counterparts earned an average of $232,074.

![2017-spotlight-women-entrepreneurs]() What Can We Do Moving Forward?

What Can We Do Moving Forward?

Despite multiple remarkably positives strides in business lending to women entrepreneurs, it’s clear that there is still work to be done.

We’re faced with a serious question: are women-owned businesses less qualified, in a traditional sense, because of barriers they face in accessing funding?

The small business lending industry has been stuck in a cycle that disadvantages women entrepreneurs, but our new data shows bits of promising news that can help address the “chicken-or-egg” problem for women small business owners.

So, what can we do moving forward?

Just as we’re encouraging working women to negotiate salaries and ask for raises, we must also encourage women business owners to apply for business financing. To really empower women entrepreneurs in the financing process, it’s important to offer full transparency into what funding can do for their businesses’ long-term growth and to provide access to tools and education to ensure their success.

We hope to see more women business owners apply for funding and use that extra cash to take advantage of opportunities to grow their businesses. Together, we can shift the small business lending industry into a positive cycle that works for women-owned businesses and not against them.

A Note on Our Data

Although we’ve helped over 100,000 small business owners understand their financing options since last June, our data for this report is comprised of only a percentage of our customers—those who were asked to self-report their gender identifications. As a result, this report covers over 9,750 small business applicants from June 2016 to September 2017. Of those applicants, roughly 7,000 were men and about 2,750 were women.

While this data only comprises a small portion of our total customer base, it is significant enough to glean insights about the larger trends that Fundera sees, and it reflects trends in the online small business lending industry as a whole.

Access a PDF version of the report here and contact us with any questions, comments, or concerns at transparency@fundera.com. We look forward to changing the industry with you.

Meredith Wood

Meredith Wood is the founding editor of the Fundera Ledger and a GM at NerdWallet.

Meredith launched the Fundera Ledger in 2014. She has specialized in financial advice for small business owners for almost a decade. Meredith is frequently sought out for her expertise in small business lending and financial management.

Related Posts

- The State of Business Lending in 2017, According to Small Business Owners

- Infographic: Spotlight on Entrepreneurship in the USA

- Gender Bias in Small Business: How People Unknowingly Judge Businesses Owned by Women

- New Study: The Best States for Women Entrepreneurs in 2017

- How Many Jobs Do Small Businesses Really Create?