IRS Form 2553 Instructions: How and Where to File

What Is IRS Form 2553?

Businesses must file Form 2553 with the IRS to elect to be taxed as an S-corporation. The form is due no later than two months and 15 days after the beginning of the tax year in which the election takes effect. After electing S-corp status, the company is taxed as a pass-through entity, so the business’s income and losses are reflected on the owners’ personal tax returns. You can have it delivered via private delivery services approved by the IRS, a list of which are available at IRS.gov/PDS.

Some companies are able to save money on small business taxes by electing to be taxed as S-corporations. S-corps are pass-through entities. Instead of the company paying a corporate tax, the owners of an S-corp report business income on their personal tax returns.

To elect S-corp tax treatment, businesses must fill out and submit Form 2553 to the Internal Revenue Service (IRS). Below, get step-by-step instructions on how to fill out this tax form, deadlines, and important things you should know prior to filing Form 2553.

In This Article

- Overview of Business Taxation and S-Corporations

- Who Can File IRS Form 2553

- How to File IRS Form 2553

- When to File Form 2553

- Where to File IRS Form 2553

- The Bottom Line

Overview of Business Taxation and S-Corporations

When you form a new business entity, the IRS will tax you based on the default tax classification for that type of business.

Default Tax Classification

| Entity | Default Tax Classification |

|---|---|

|

C-corporation

|

Corporation

|

|

Single-member LLC

|

Sole proprietorship

|

|

Multi-member LLC

|

Partnership

|

By default, sole proprietorships and general partnerships are regarded as pass-through entities for tax purposes. This means business owners report their share of business income and losses on their personal tax returns.

By default, corporations are regarded as C-corporations for tax purposes. A C-corp pays a 21% corporate income tax on the business’s net taxable income for the year. Shareholders also pay a dividend tax on any distributions from the corporation.

LLCs can choose whether to be taxed as a pass-through entity or as a corporation.

Why Would You File IRS Form 2553?

By filing IRS Form 2553, you elect to have your C-corporation or LLC treated as an S-corporation for federal tax purposes. S-corps are corporate entities like C-corps but they’re taxed significantly differently.

S-corporations are pass-through entities. This means that S-corps don’t pay a corporate tax. Instead, shareholders report their share of the business’s income, losses, credits, and deductions on their personal income tax returns. The income gets taxed at the shareholders’ personal income tax rates.

In 2019 when a series of business tax cuts took effect, owners of S-corps and other pass-through entities were given the option to deduct 20% of their net business income before taxes are calculated.

Many business owners choose to file IRS Form 2553 and have their company taxed as an S-corporation in order to lower their taxes. Although tax obligations vary by business, C-corporations tend to pay the highest taxes because they get hit with taxation twice—once at the corporate level, and again at the shareholder level for dividends.

Who Can File IRS Form 2553?

C-corps and LLCs can follow our IRS Form 2553 instructions to elect S-corp tax status. If you have an LLC, filing this form won’t completely change anything from a legal standpoint, your company will still be an LLC. However, for federal tax purposes, you’ll be taxed as an S-corp.

You’re eligible to file Form 2553 if all of the following are true:

- The company must be a domestic corporation.

- The company has fewer than 100 shareholders and only one class of stock (shares owned by family members can be treated as one shareholder).

- All shareholders must be individuals, estates, certain types of trusts, and exempt organizations (e.g. nonprofits).

- All shareholders must be U.S. citizens, permanent residents, or resident aliens.

- The company generally can’t be a bank, insurance company, or thrift savings institution.

- The company must adopt a calendar tax year ending Dec. 31 or other eligible fiscal year.

- Each shareholder consents to S-corp status.

If you meet the above requirements, your company can become an S-corp for federal tax purposes by following our IRS Form 2553 instructions for filing.

How to File IRS Form 2553: Instructions

IRS Form 2553 is a four-page form that contains information about a business and its shareholders. The information you provide impacts whether the IRS will approve S-corp tax status and when the status will take effect.

Here are step-by-step IRS Form 2553 instructions:

Photo credit: IRS.gov

Photo credit: IRS.gov

Photo credit: IRS.gov

Photo credit: IRS.gov

Part I: Election Information

Part I of IRS Form 2553 asks for basic information about your business, including the company’s complete name, address, and employer identification number (if applicable). You should also provide the date and state in which your business was incorporated or registered.

In item E of Part I, enter the date on which you want your S-corp tax election to take effect, paying careful attention to filing deadlines. In most cases, you must file IRS Form 2553 no later than two months and 15 days after the effective date of S-corp election. If you have a new business and are electing S-corp tax status for your very first tax year, you should put down the earliest of these dates in item E—the date the business first acquired assets, the date that business transactions commenced, or the date that shareholders were first acquired.

In Part I, you’ll also specify your fiscal year or calendar year, as well as the contact information for your business attorney or business officer that the IRS should contact for more information. Late filers should provide an explanation for the delay in Part I.

The last section of Part I contains a table, with a row documenting each shareholder’s consent to S-corp tax treatment. You’ll need each shareholder’s name and address, social security number/tax ID, tax year start and end, and the number of shares or percentage of ownership. There’s space for only seven shareholders, so if you have more, attach an extra sheet with the same columns of information. An officer of the company, such as the company president, must sign at the end of Part I.

Photo credit: IRS.gov

Photo credit: IRS.gov

Part II: Selection of Fiscal Tax Year

Most companies follow a fiscal year of January 1 to December 31. A fiscal year, or tax year, is an annual period used for accounting and tax purposes. If your company’s fiscal year doesn’t end on December 31, then you have to fill out Part II of IRS Form 2553. In Part II, you essentially provide a justification to the IRS of why they should allow you to use a non-calendar tax year.

Here’s when non-calendar tax years make sense for certain types of businesses:

- Natural business year: Some seasonal businesses follow a natural business year that culminates with a slow period for the company. For example, a boating company might have a fiscal year spanning from October 1 to September 30, because revenue decreases significantly after the summer season.

- Ownership tax year: Some businesses follow a fiscal year based on the preferences of a majority of shareholders. This is called an ownership tax year.

- Business purpose tax year: There might be another business purpose that leads you to select a non-calendar for your company.

- Section 444 tax year: Section 444 of the tax code lets businesses choose a fiscal year ending on specific dates if the business makes periodic tax payments throughout the year.

Use item P in Part II to indicate if you’re using the natural business year or ownership tax year tests. Item Q is for companies with another business purpose. Companies using “business purpose” to justify their fiscal year will have to pay a $5,800 fee after filing IRS Form 2553. Use Item R to indicate a Section 444 fiscal year.

Photo credit: IRS.gov

Photo credit: IRS.gov

Part III: Qualified Subchapter S Trust Election

Part III of IRS Form 2553 doesn’t apply to most small businesses. A Qualified Subchapter S Trust (QSST) that wants to hold stock in an S-corp must fill out Part III of IRS Form 2553. A QSST is a type of trust with a single beneficiary. Income from the trust is distributed at least on an annual basis.

Photo credit: IRS.gov

Photo credit: IRS.gov

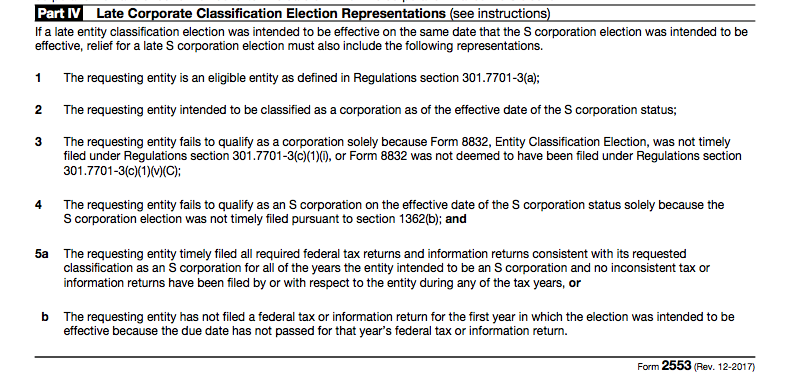

Part IV: Late Corporate Classification Election Representations

You can skip Part IV unless your company is an LLC that is filing IRS Form 2553 after the deadline. If this section does apply to you, then by signing IRS Form 2553, you’re agreeing with the representations shown in part IV. Don’t forget to explain your reason for late filing to the IRS, either in line I of Part I or in a separate, attached statement.

Photo credit: IRS.gov

When to File IRS Form 2553

The deadline to file IRS Form 2553 is two months and 15 days after the start of the tax year in which you want the election to take effect. Established businesses can also file any time during the preceding tax year. This means no later than March 15 for most businesses, but deadlines can differ for new companies and companies that follow a non-calendar tax year.

Here are a few examples of IRS Form 2553 deadlines:

- Established business: If your business has been around for a while, then you have already filed taxes at least once. Let’s say you want to change your tax status to S-corp starting January 1, 2021. You have until March 15, 2021, to file IRS Form 2553. You can also file the form anytime during 2020.

- New business: If you have a new business, then you won’t have any previous tax filings. Let’s say you have a new business whose tax year starts January 1, 2021. Your IRS Form 2553 would be due by March 15, 2021, but you can’t file before January 1.

- Seasonal business: Let’s say you have a seasonal business and your tax year starts October 1. Your IRS Form 2553 would be due by December 15.

No matter your specific deadline, filing IRS Form 2553 on time is important if you want to take advantage of S-corp tax treatment for a specific tax year. If you file too late, you might have to wait one more year for the election to take effect.

Missed the Filing Deadline? IRS Form 2553 Late Filing Relief

If you miss the filing deadline for IRS Form 2553, all is not lost. You can still obtain S-corp status for the coming tax year if you can show a “reasonable cause” for the delay. Your explanation for the delay can be provided on line I of IRS Form 2553 or on an attached statement. To receive a pass from the IRS, shareholders should “act like an S-corp” from the date the S-corp status was to take effect. For instance, shareholders should have reported business income and losses on their personal tax returns.

Note that you will see mention of IRS Form 8832 in the instructions to IRS Form 2553. Form 8832 is for LLCs that want to be taxed as a C-corp and for other businesses that want to change their tax classification. IRS Form 2553 is specifically for LLCs and C-corps that want to elect S-corp tax status.

Photo credit: IRS.gov

Where to File IRS Form 2553

Filing options for IRS Form 2553 include mail and fax filing. You cannot file this form online. Based on your business’s principal business location, use the addresses or fax numbers shown above to file. Make sure you double-check the IRS website because addresses and fax numbers can change periodically. And be sure to send in your original form if you’re filing by mail. If you opt for fax, store the original copy of the form in a safe place.

After submitting IRS Form 2553, you can expect to hear a response back from the IRS within 60 days (add on an additional 90 days if you use a business purpose fiscal year). The IRS will tell you if they’ve accepted or rejected your request for S-corp tax status.

Once you make an election, it stays in effect until your company dissolves or changes tax status again. If you terminate or revoke S-corp status, you generally cannot re-apply for S-corp tax treatment for five years.[1]

There’s no fee to submit Form 2553, but in specific situations, the IRS will assess a fee. For example, if you select a non-calendar tax year based on a specific business purpose (Part III, item Q), you’ll be assessed a $5,800 fee. This fee should not be sent in with IRS Form 2553, however. You’ll receive a separate bill from the IRS instructing you how to pay. In some cases, an S-corp election filed after the IRS deadline will also incur a late fee.

The Bottom Line

Remember, you don’t have to elect a tax status for your business entity. The IRS automatically taxes businesses based on their default tax classification. However, if you want to take advantage of S-corp tax status, then you have to file Form 2553 with the IRS.

Fortunately, filling out this form shouldn’t be too difficult if you follow the IRS Form 2553 instructions above. If you have questions or are unable to get through the form yourself, we suggest hiring a tax attorney or using an online legal service that will complete and file the form on your behalf.

Article Sources:

- LegalZoom.com. “When Can I Revoke an Election in a n S-Corporation?“

Priyanka Prakash, JD

Priyanka Prakash is a senior contributing writer at Fundera.

Priyanka specializes in small business finance, credit, law, and insurance, helping businesses owners navigate complicated concepts and decisions. Since earning her law degree from the University of Washington, Priyanka has spent half a decade writing on small business financial and legal concerns. Prior to joining Fundera, Priyanka was managing editor at a small business resource site and in-house counsel at a Y Combinator tech startup.

Featured

QuickBooks Online

Smarter features made for your business. Buy today and save 50% off for the first 3 months.

- Business Property Tax: The Ultimate Guide

- Form 1040X Instructions: How to File Form 1040X Amended Tax Return

- Self-Employment Taxes and SECA: Tax Obligations for the Self-Employed

- Sales Taxes: The Ultimate Guide for Small Business Owners

- What Is a Business Audit, and What Types of Audits Should You Be Ready For?